The smart Trick of Summitpath Llp That Nobody is Discussing

The smart Trick of Summitpath Llp That Nobody is Discussing

Blog Article

An Unbiased View of Summitpath Llp

Table of ContentsHow Summitpath Llp can Save You Time, Stress, and Money.How Summitpath Llp can Save You Time, Stress, and Money.Little Known Facts About Summitpath Llp.The Of Summitpath LlpNot known Factual Statements About Summitpath Llp

A monitoring accountant is a key function within a business, yet what is the function and what are they anticipated to do in it? Working in the book-keeping or money division, monitoring accounting professionals are responsible for the preparation of monitoring accounts and numerous other reports whilst likewise supervising basic bookkeeping treatments and practices within the company - bookkeeping service providers.Compiling methods that will certainly decrease service costs. Acquiring money for projects. Encouraging on the economic effects of company choices. Creating and overseeing monetary systems and procedures and identifying chances to boost these. Controlling income and expenditure within the company and making certain that expense is inline with budgets. Supervising accountancy professionals and support with common book-keeping tasks.

Trick monetary information and records produced by administration accountants are utilized by senior management to make educated service choices. The evaluation of company performance is an important duty in a management accountant's task, this analysis is created by looking at present monetary information and also non - financial information to identify the setting of the business.

Any service organisation with a monetary department will certainly require an administration accounting professional, they are likewise often utilized by monetary institutions. With experience, a management accountant can expect strong profession development.

Unknown Facts About Summitpath Llp

Can see, examine and encourage on alternating resources of organization finance and different methods of elevating finance. Communicates and advises what effect financial choice making is having on advancements in law, values and governance. Assesses and recommends on the best approaches to manage organization and organisational efficiency in connection with service and finance threat while communicating the influence efficiently.

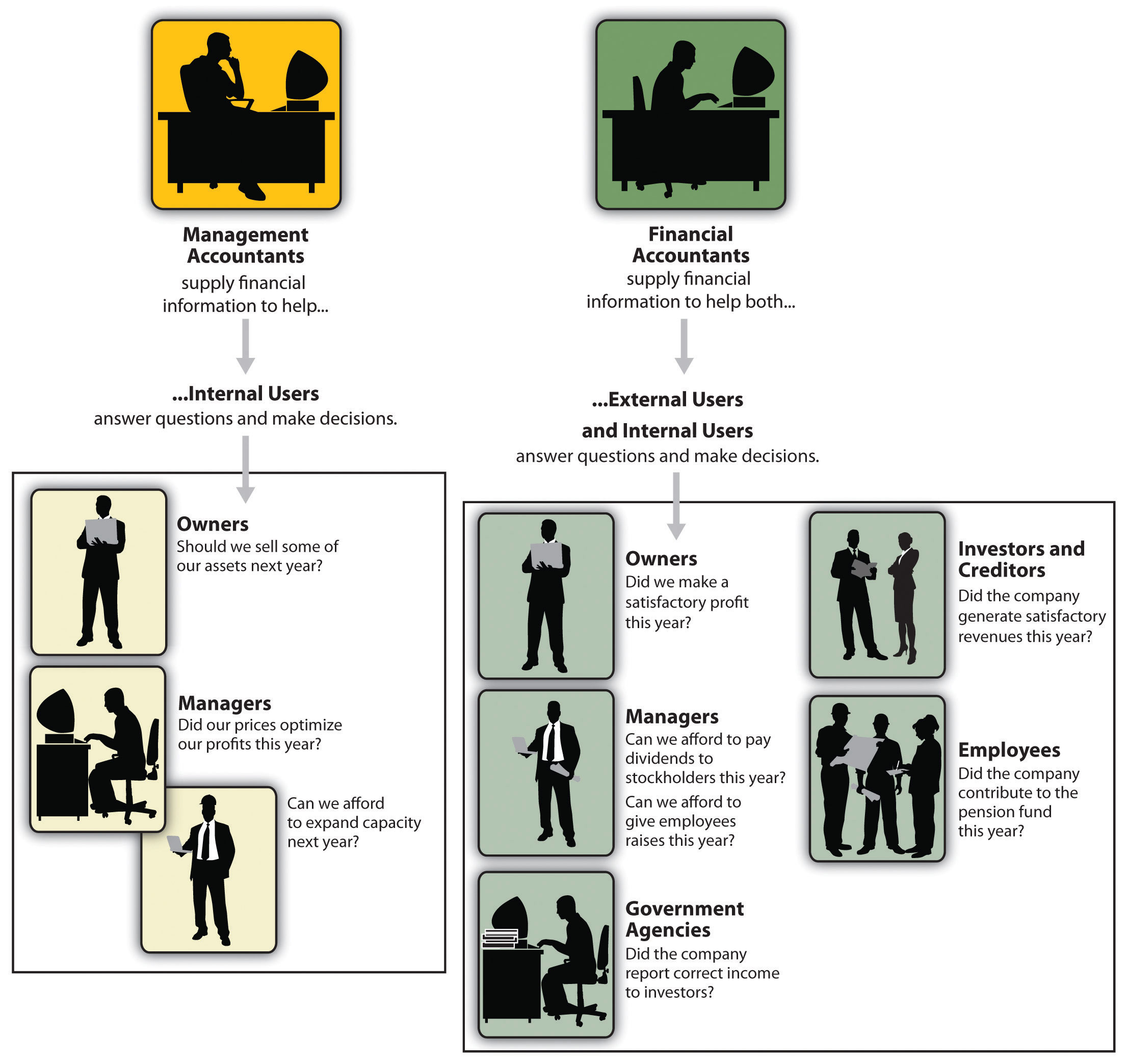

Makes use of different ingenious methods to execute method and handle adjustment - tax planning. The distinction in between both financial accounting and supervisory accountancy problems the intended customers of information. Supervisory accounting professionals call for organization acumen and their objective is to work as business companions, helping magnate to make better-informed choices, while monetary accountants intend to generate monetary papers to provide to exterior celebrations

The 8-Minute Rule for Summitpath Llp

An understanding of service is also crucial for monitoring accounting professionals, together with the capability to connect properly in all levels to suggest and communicate with elderly members of team. The duties of a management accounting professional ought to be executed with a high level of organisational and calculated thinking abilities. The average income for a chartered administration accounting professional in the UK is 51,229, a rise from a 40,000 average earned by monitoring accounting professionals without a chartership.

Giving mentorship and leadership to junior accounting professionals, fostering a society of partnership, development, and functional excellence. Teaming up with cross-functional groups to develop spending plans, forecasts, and long-lasting financial techniques. Staying informed concerning modifications in audit guidelines and finest techniques, applying updates to interior processes and paperwork. Essential: Bachelor's degree in audit, finance, or a related area (master's preferred). Certified public accountant or CMA certification.

Generous paid time off (PTO) and company-observed vacations. Expert advancement possibilities, consisting of compensation for CPA qualification expenses. Flexible my explanation work options, consisting of hybrid and remote schedules. Access to wellness programs and worker aid resources. To apply, please submit your return to and a cover letter describing your certifications and passion in the senior accountant function. outsourcing bookkeeping.

The Single Strategy To Use For Summitpath Llp

We're excited to discover a proficient senior accounting professional all set to add to our business's economic success. For questions concerning this setting or the application process, contact [HR get in touch with details] This job posting will end on [date] Craft each section of your job description to mirror your company's special requirements, whether hiring a senior accountant, corporate accounting professional, or another specialist.

A solid accounting professional job account surpasses noting dutiesit clearly communicates the certifications and assumptions that align with your company's demands. Differentiate between essential qualifications and nice-to-have skills to help candidates evaluate their suitability for the position. Define any accreditations that are compulsory, such as a CERTIFIED PUBLIC ACCOUNTANT (Cpa) permit or CMA (Qualified Administration Accounting professional) designation.

10 Easy Facts About Summitpath Llp Explained

Comply with these best techniques to produce a job summary that reverberates with the best candidates and highlights the distinct facets of the duty. Bookkeeping roles can differ widely depending on standing and field of expertise. Prevent ambiguity by laying out particular tasks and locations of focus. As an example, "prepare month-to-month financial declarations and supervise tax obligation filings" is far more clear than "manage economic documents."Mention essential locations, such as financial coverage, bookkeeping, or payroll monitoring, to bring in candidates whose abilities match your needs.

Utilize this accountant work summary to develop a job-winning return to. Accounting professionals help companies make critical financial decisions and corrections. They do this in a variety of ways, consisting of research, audits, and information input, reporting, analysis, and tracking. Accounting professionals can be responsible for tax coverage and declaring, fixing up equilibrium sheets, assisting with department and business spending plans, monetary projecting, connecting searchings for with stakeholders, and more.

Report this page